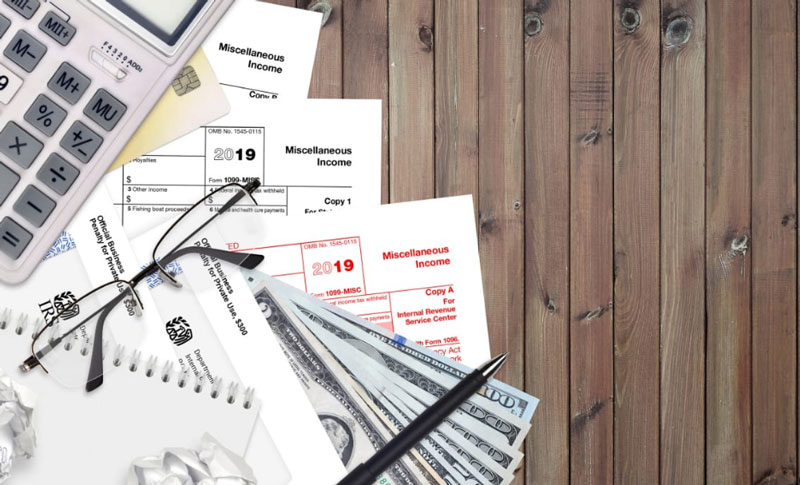

What Is IRS Form 8949 And Its Purpose?

Feb 12, 2024 By Triston Martin

Form 8949 is a form used to calculate the cost basis of an asset when it has been held for more than one year. It is required to complete Schedule D and follow IRS guidelines for capital gains and losses.

This form can be completed by taxpayers who have owned at least one asset with a cost basis of more than $500 in any of the past five years and taxpayers who acquired assets solely through gifts or inheritances during 2015.

This blog post will discuss what type of information should be included on IRS Form 8949, its purpose and how much time it takes to complete this form.

If you are looking for a review on how to fill out Form 8949, look at this post for helpful hints.

Who needs to file Form 8949?

Detailed information about what should be reported on IRS Form 8949 can be found here. Generally, the following taxpayers are required to complete IRS Form 8949 and Schedule D:

1. Taxpayers who bought and sold assets worth more than $10,000 in 2015. This includes securities traded through stockbrokers or investment funds purchased through mutual funds or brokerage accounts.

2. Taxpayers who received gifts, inheritances, and/or business transactions during 2015. These transactions are in addition to any assets the taxpayer bought and sold in 2015.

3. Taxpayers who acquired assets solely through a gift or inheritance in 2015. These include shares given by a spouse, people making a gift of property worth more than $5,000 per person per year, and certain business transactions involving more than one asset.

4. Taxpayers who purchased assets from other people during 2015 if the asset's value was more than $5,000 and if either party owns an interest in any partnership or S corporation for all or part of that year.

How long does it take to complete IRS Form 8949?

The following information is helpful when deciding how long it takes to complete Form 8949:

1. When filing Schedule D with the IRS, the total cost basis of all assets held for more than one year will be reported. However, the cost basis of any asset that was acquired as a gift or inheritance in 2015 will not be included in Schedule D.

For example, if you purchased an asset that was worth $500 and you received a gift of $500 in 2015, on your 2015 Schedule D Report, the total cost basis would be $0, but on your 2016 Schedule D, that amount would include the $500 from the gift.

2. If a taxpayer receives a gift, inheritance, or business transaction in 2015 for which the total cost basis is less than $5,000 per person per year, the IRS does not require them to complete Form 8949 and Schedule D.

3. Taxpayers who purchased assets from other people during 2015 must complete IRS Form 8949 if either party owns an interest in any partnership or S corporation for all or part of that year.

However, if the total cost basis of all assets owned by both parties is less than $5,000 each, they do not need to file Form 8949 with the IRS, but are still required to complete Schedule D with their return instead of Schedule C.

4. Taxpayers who complete IRS Form 8949 are still required to complete Schedule C with their 1040 federal tax return.

5. The total cost basis reported on IRS Form 8949 (the amount of money spent over the years) must match the total cost basis reported on Schedule D to avoid any potential penalties or taxes owed.

6. Taxpayers must report all trades, stock splits, and dividend reinvestments in 2015, even if those transactions did not result in increased profits or losses.

7. The total net gain or loss amount must be reported on IRS Form 8949, but it can be combined with other forms such as 1099-B and 1099-S.

8. Taxpayers should use a separate IRS Form 8949 for each asset or transaction and each year.

9. The information provided on IRS Form 8949 does not need to be submitted in the same order. For example, the taxpayer can list transactions from their earliest to latest purchase date or oldest asset to new to save space on the form because that makes more sense.

However, the taxpayer must still provide all required information such as purchase date, cost basis, proceeds/sale price, and whether they realized a gain or loss during the transaction before submitting their forms to the IRS with their other tax documents.

10. No maximum amount of assets or transactions can be reported on IRS Form 8949 and Schedule D.

11. Due date for completing Form 8949 and Schedule D is April 15, 2016, for 2015 tax returns.

12. Taxpayers can prepare their forms or ask their CPA to help them complete them.

13. Form 8949 and Schedule D must be signed by the taxpayer and include the taxpayer’s social security number or ITIN (individual tax identification number). Prior year forms are not required to be signed by the taxpayer because they are only used for internal IRS purposes and do not report any information to the IRS directly from those forms.

14. If a taxpayer receives a 1099-B or 1099-S form with information that they do not recognize, they should contact the issuing party to determine if it is an error or if it is an additional income source that they must declare on their tax return.

Some taxpayers forget to file their Schedule D, which requires them to file Form 8949 and pay a fee of $53 when filing their return.

Conclusion

The IRS Form 8949 is a critical document in the process of filing your taxes. It's important to understand this form and how to complete it correctly so you can get the most out of your tax return.

AI Powerhouses of 2024: 8 Companies Driving Innovation

Boosting Efficiency: Batch Append Credit Scores and Risk Scoring Techniques

What Exactly Is Tax Evasion?

Navigating the Landscape of B2B Marketing: Strategies and Tactics

NorthOne Business Banking Review 2024: Simplified and Effective Solutions

The role of information and communication in financial intermediation

Find Q3 Investments in Technology and Advanced Analytics

What Exactly Is An Affinity Card

Hidden Cost to Buying a Home