Banking

An In-Depth Look at Lex Levinrad's Strategies: 2024 Review

Explore Lex Levinrad's innovative real estate investing strategies for 2024, focusing on education, sustainability, and the importance of a growth mindset.

Read More

Choosing the Right Path: Earn2Trade or Topstep in the Year 2024?

Discover how Earn2Trade and Topstep offer unique opportunities for traders through educational resources, community engagement, and funding pathways for success.

Read More

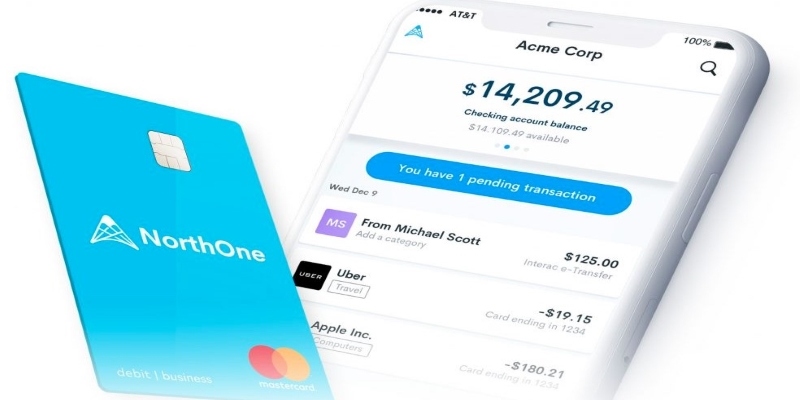

NorthOne Business Banking Review 2024: Simplified and Effective Solutions

Explore our in-depth NorthOne Business Banking Review 2024, covering features, benefits, pricing, pros, cons, and whether it's worth your business's investment

Read More

Navigating Financial Freedom: A Comprehensive Guide to Consolidated Credit Debt Relief

Unlock financial freedom with Consolidated Credit's debt relief solutions: consolidation, settlement, and management plans.

Read More

What is the Effect of Background Check on Your Credit Score?

In this comprehensive exploration, we delve into the intricate connection between background checks and their potential effect on your credit score.

Read More

The role of information and communication in financial intermediation

Financial intermediaries need to solve information and communication problems that can affect the effective allocation of social resources.

Read More

Capital One Venture X Rewards Credit Card: For Frequent Travelers

Ready to unlock the benefits of a rewards credit card for frequent travelers? Find out why the Capital One Venture X Rewards Credit Card is perfect for your next vacation

Read More

The Smart Shopper's Guide to Using Basis Points for Better Financial Decisions

Make informed financial decisions with our Smart Shopper's Guide to Basis Points. Learn how to use them to your advantage and save money.

Read More

Methods for Deciding on the Best Retirement Savings Plan

you may use a savings account for the long term to save up for things like retirement, college, or other significant purchases. After retiring, you may spend your savings on whatever you need, from huge, one-time purchases to small, regular living costs. By contrasting the interest rates, potential returns, and fees, you'll be better positioned to decide where to deposit your money.

Read More

The Lure of Convenience Checks

Convenience check is a blank check that you get in mail, and there is a solid reason why you continue to receive them from credit card company: such checks make it simple for you to deposit huge sums on your card. They often come from a credit card business where you already have an account, and they are associated with that account

Read More

Understanding the Role of a Private Banker: Is It Right for You?

Explore the world of private banking, understand its pros and cons, and see if hiring a private banker is the right way to manage your wealth.

Read More

The Best Options Besides Traditional Savings Accounts

Traditional savings accounts offer a safe option, but they may need to provide a better return on investment. Alternatives include high-yield savings accounts, certificates of deposit, money market accounts, bond funds, and Real Estate Investment Trusts (REITs). Each option offers different benefits and risks. It's important to consider your financial goals and risk tolerance before choosing the best option. Consulting a financial advisor is also helpful.

Read More

Credit Cards That Offer 2% Or More In Cash Back On All Purchases

A credit card that gives you 2% cash back or more on all transactions is a great way to get the most out of your money.

Read More

First Tech Federal Credit Union Review

First Technology Personal loans from Federal Credit Union are promised to be processed quickly. The lender claims that you may acquire your own unique rate for a loan with terms of two years in "thirty seconds or less." If you need money and don't have excellent credit, don't worry; you may still meet the criteria for a personal loan. There is a "complete variety of items to provide to all credit kinds," as stated by First Tech.

Read More

Reasons to Have Multiple Accounts

You can have to check accounts open at many banks simultaneously; however, doing so comes with benefits and drawbacks. Because having just one bank account makes the banking process easier, most individuals only have one bank account.

Read More

Simplifying Direct Deposit: How to Write a Voided Check

A comprehensive guide on writing a voided check, highlighting its importance for financial transactions like setting up direct deposits. It outlines the step-by-step process and key details to include on the check, such as date, payee, amount, and bank routing and account numbers. To avoid errors, it emphasizes using dark ink, correctly inputting all the details, and keeping a copy.

Read More

The 4 Most Effective Apps For Saving Cash In 2022

No matter where you are in your financial life, using one of the best money-saving apps might be a good first step. Anyone with a bank account and a smartphone may benefit from these convenient services. There are several possible methods for saving money using apps. However, their primary purpose is to inspire you to begin an automatic savings regimen

Read More

Reasons Why Banks Don't Need Your Money to Make Loans

Banks serve as a bridge between borrowers and savers in the financial system. On the other hand, banks use a fractional reserve banking system that allows them to lend more money than they have in their accounts.

Read More

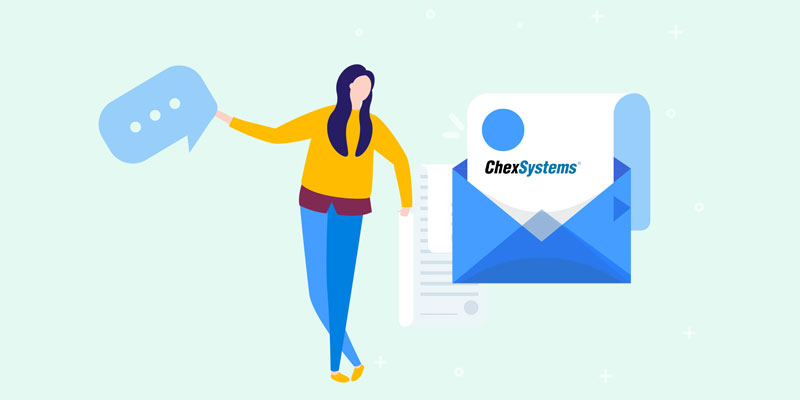

Clearing Up Your ChexSystems Report

ChexSystems is used to provide necessary information about how deposit accounts, such as checking and savings accounts, are used by consumers. This information is fed to their database by financial institutions like banks and credit unions or companies where said accounts were used to make purchases. We lay out the necessary steps you would need to take if your ChexSystems report is not what you expected.

Read More

Credit Cards Annual Fee

There are several circumstances in which it does not make economic sense to pay an annual fee for a credit card. There is no shortage of credit cards that do not charge an annual fee.

Read More

Putting Down Payments on Wheels: Can You Use a Credit Card?

Curious about using your credit card for a car down payment? This article explains the pros and cons, plus tips for a smooth transaction.

Read More

What Exactly Is An Affinity Card

Affinity cards are credit cards that include a charitable organization's logo on the front. Every time a purchase is made using the card, the issuing bank will donate a small portion of the money to the designated charity. Other organizations, including alum clubs, teams, and professional associations, can also benefit from using affinity cards

Read More

A Complete Citi Premier Card Review 2022

The annual fee for the Citi Premier® Card is quite low compared to the value you receive from the card's perks. Unlike the more well-known choices from Chase and American Express, this card hasn't gotten much attention, even though it offers bonus benefits and additional travel features. It's too bad, considering this is a top-notch travel card in terms of value and flexibility. Reading our in-depth review, find out what makes the Citi Premier® Card unique.

Read More

How Your Credit Cards Can Help During a Recession

Learn more about using credit cards responsibly and securely during an economic recession with this helpful blog post. Discover the ins and outs of personal finance in recessions to ensure your money works for you. Start planning today with a little research.

Read More

Methods to Gain Miles Apart From Using an Airline Credit Card

Airline credit cards are indeed a terrific method of earning miles with your preferred regular flyer program, however, a co-branded or platinum card is not required to receive rewards. These methods may be more time-consuming, but they will get you closer to your goal of earning enough miles for a free ticket. Learn about the many alternatives to using a credit card to accrue miles.

Read More