Reasons Why Banks Don't Need Your Money to Make Loans

Nov 18, 2023 By Triston Martin

Banks are traditionally viewed as financial intermediaries connecting borrowers and savers by acting as reliable middlemen, enabling the two parties' transactions.

Individuals who make more money than they need can save it for the future by depositing it in a trustworthy bank and creating a savings account. Person money can subsequently be used to lend to those whose incomes fall short of their immediate consumption demands by the bank. In the following sections, see how banks utilise your deposits to make loans and what amount they need your money.

How It Works

As depicted above, the size of a bank's deposit base determines its ability to make loans. To increase its lending capacity, a bank needs to increase its customer base to secure fresh deposits. Deposits are necessary for loans to exist; in other words, deposits are the source of loans.

Bank lending stories are often accompanied by the "money multiplier idea," which is consistent with what is known as fractional reserve banking.

The reserve requirement specifies the size of this fraction, and the reciprocal of that determines the multiple reserves banks can lend out. The multiplier is ten if the reserve requirement is 10% (i.e., 0.1). This means that banks can lend out ten times more than their reserves.

The central bank's monetary policy decisions on whether or not to boost reserves limit bank lending capability, not just their ability to attract new deposits. Commercial banks can only increase their lending capacity by securing new deposits if they operate under a specific monetary policy regime and are not allowed to increase their reserves. In other words, because deposits lead to loans, banks require deposits from you to make additional loans.

Banking in the Real World

Rather than being formed by a group of people putting their money in a bank and trusting it to keep it safe, deposits are created when banks offer credit in today's modern economy. (i.e., make new loans). Banks "generate credit," which means they develop deposits in the lending process rather than giving out the money they have been given.

When a bank makes a loan, it records two entries in its books: one under assets and the other under liabilities. It is an asset to the bank and a disservice to the depositors simultaneously. On the other hand, loans generate deposits, contrary to the narrative above.

This may come as a surprise, given that if loans generate deposits, then private banks are the ones creating new money. However, you may be wondering, "Isn't the production of money solely the right and obligation of central banks? ", If you believe that the reserve requirement restricts banks' ability to lend, then indeed, banks cannot generate money unless the central bank either relaxes the reserve requirement or increases the number of reserves in the banking system.

Bank lending and money creation are not constrained by the reserve requirement, which is a purely theoretical concept. The truth is that banks first lend money and then look for the necessary reserves to repay the loans later on.

Why Aren't More People Getting Loans?

So, if the reserve requirement doesn't constrain banks, what other constraints do they have? This question can be answered in two ways, but both are related. An easy way to explain this is that banks are constrained by their desire to maximise profits rather than by reserve requirements when faced with a specific demand for credit.

To get to our second answer, we need to include the word "risk." Because the federal government insures bank deposits, banks may be tempted to take unnecessary risks when making loans. The government guarantees deposit accounts. Hence excessive risk-taking by banks is in the government's best interest. Capital regulations have been developed to ensure that banks have an appropriate level of capital relative to their existing assets because of this.

If capital constraints, not reserve requirements, restrict bank lending, that is the case. Although capital needs are described as a ratio whose denominator is risk-weighted assets (RWA), they depend on how risk is quantified, based on subjective human judgement.

Some banks may underestimate the riskiness of their assets due to subjective judgement and an ever-increasing desire for profit. Banks still have much room to lend, even if they have to meet regulatory capital requirements.

The Conclusion

As a result, banks' ability or inclination to lend is hampered by profitability expectations. Because banks don't need your money but want your money, here is why. Even though banks prefer to lend money first and then hunt for reserves afterwards, they do so.

Simplifying Direct Deposit: How to Write a Voided Check

Understanding the Role of a Private Banker: Is It Right for You?

Credit Cards Annual Fee

The Best Options Besides Traditional Savings Accounts

What is HELOC and how does HELOC work?

Strategies to achieve financial fitness

The Smart Shopper's Guide to Using Basis Points for Better Financial Decisions

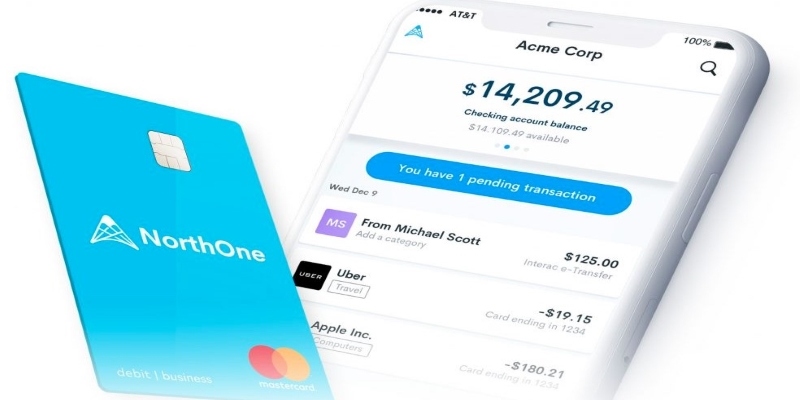

NorthOne Business Banking Review 2024: Simplified and Effective Solutions

Things You Need to Know About Tax Software