Understanding FICA Taxes: What You Need to Know

Oct 11, 2023 By Triston Martin

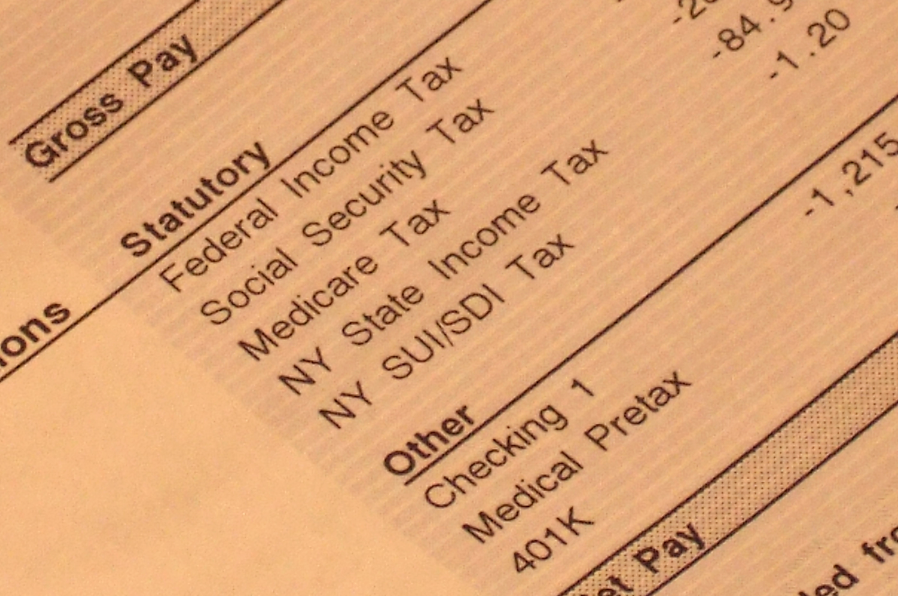

Tax season might not be the most exciting time of the year, but it's an essential part of life. You've probably heard of federal income taxes, but have you ever wondered about those mysterious FICA Taxes that appear on your paycheck? If you're scratching your head, don't worry – you're not alone.

In this conversational and straightforward article, we'll break down everything you need to know about FICA Taxes, from what they are to how they impact your financial future.

What Are FICA Taxes?

FICA Taxes are a duo of mandatory deductions on your pay stubs. FICA stands for Federal Insurance Contributions Act, which may sound like a mouthful, but we'll keep things simple.

The Historical Foundation

To understand FICA Taxes better, let's take a brief trip back in time. The Social Security Act, signed into law by President Franklin D. Roosevelt in 1935, established the framework for what we know today as FICA Taxes. Its primary goal was to provide financial security for retired workers during the Great Depression.

Over the years, this Act has evolved to encompass broader forms of assistance, such as disability and survivor benefits.

The Two Parts of FICA Taxes

FICA Taxes consist of two parts:

- Social Security: This part is like a safety net for retirees, survivors, and those with disabilities. When you pay into Social Security, you invest in your future financial security. Think of it as a savings account you can tap into when you reach retirement age or face unexpected challenges.

- Medicare: Medicare is your ticket to affordable healthcare once you hit 65. When you contribute to Medicare through FICA Taxes, you set yourself up for comprehensive health coverage in your golden years.

Understanding these two components is essential because they directly impact your financial well-being.

Who Pays FICA Taxes and How Much?

Almost everyone does. If you earn a paycheck, you're likely to see these deductions. This includes employees, self-employed individuals, and even some government workers.

FICA Taxes aren't a one-size-fits-all deal. The amount you contribute depends on how much you earn.

Here's the lowdown:

- Social Security: In 2021, the Social Security portion of FICA Taxes applied to the first $142,800 of your income. You paid a flat rate of 12.4% (6.2% from you and 6.2% matched by your employer) up to that limit. Any income above that threshold was exempt.

- Medicare: The Medicare portion is a bit more straightforward. You pay a flat rate of 2.9% (1.45% from you and 1.45% from your employer) on all your earnings. Unlike Social Security, there's no income cap, which applies to your entire income.

- Self-Employed Individuals: If you're self-employed, you might wonder how FICA Taxes work. Instead of an employer covering half of your FICA Taxes, you're on the hook for the full amount. But don't worry; there's a silver lining. You can deduct the employer's portion when calculating your income tax.

The Benefits of Paying FICA Taxes

Now that we've covered who pays and how much, let's explore why FICA Taxes matter to you.

Social Security Benefits

Paying into Social Security is like securing your financial safety net. When you retire, become disabled, or if you pass away, you or your loved ones can receive benefits. These payments can help cover essential expenses and maintain your quality of life.

Social Security isn't just a retirement fund; it's a lifeline that offers financial security during challenging times. Knowing you're contributing to this safety net can provide peace of mind.

Furthermore, it's important to understand that Social Security benefits are not solely based on your contributions. The program is designed to be progressive, providing more significant benefits to those with lower lifetime earnings.

So, even if you've had periods of lower income or part-time work, you can still count on Social Security to provide valuable support in your retirement years. It's a testament to its role in promoting financial equity and ensuring everyone can enjoy a comfortable retirement.

Medicare Benefits

Medicare is your key to affordable healthcare during your retirement years. You'll be eligible for this crucial health coverage when you turn 65 and have paid Medicare taxes through FICA throughout your working life. It can ease the burden of medical expenses and ensure you receive necessary healthcare services.

Healthcare costs can be a significant financial concern, especially as you age. Contributing to Medicare ensures that you have access to medical services without breaking the bank.

It's worth noting that while Medicare primarily kicks in at age 65, it can also cover individuals with certain disabilities, regardless of their age. Understanding the ins and outs of Medicare, including its various parts (A, B, C, and D), can help you make informed decisions about your healthcare needs as you approach retirement.

Medicare offers various services, from hospital stays to preventive care, ensuring you have the coverage you need for a healthier, worry-free retirement.

The Future of FICA Taxes

FICA Taxes aren't set in stone. They can change over time as the government adapts to new economic challenges and healthcare needs. For instance, the age at which you can collect full Social Security benefits has increased gradually. Staying informed about these changes is vital for planning your financial future.

The government periodically reviews and adjusts FICA tax rates and policies to ensure the sustainability of Social Security and Medicare programs. Keeping an eye on these developments will help you make informed financial decisions.

Conclusion

In conclusion, FICA Taxes might seem like just another deduction from your paycheck, but they play a vital role in your financial security and access to healthcare in retirement. Understanding how FICA Taxes work empowers you to make informed decisions about your financial future.

So, the next time you glance at your pay stub and see those FICA deductions, you'll know you're not just losing a chunk of your income. You're investing in a safety net for your retirement and ensuring access to healthcare when you need it most.

Robo-Advisors: A Game-Changer in Managing Your Financial Future

How Much Do Taxes Cost Small Businesses?

Which Are The Best Long-Term Savings Plans That Make Good Financial Cents

First Tech Federal Credit Union Review

Capital One Venture X Rewards Credit Card: For Frequent Travelers

What Is Alternative and Non-Traditional Data? A Detailed Guide

Find Q3 Investments in Technology and Advanced Analytics

Cash App Taxes Review 2024: Everything You Need to Know

The 4 Most Effective Apps For Saving Cash In 2022