How Much Do Taxes Cost Small Businesses?

Oct 24, 2023 By Triston Martin

As a result, it's possible that by the end of 2021, the average top tax rate across the board will have settled at around 25.8 percent. Have you started your own small business? If you include among your admirers, According to the U.S. Department of Commerce's Small Business Administration, 99.9 percent of all U.S. businesses fall into the category of "small" (PDF). In most people's minds, a corporation is what immediately comes to mind when they consider taxes levied against businesses. In practice, however, most businesses do not pay company taxes, especially those on the lower end of the spectrum. Owners of single businesses or those in partnerships face this problem.

State Taxes For Small Businesses Are Not Uniform

The tax laws in each state vary. Some states don't even require residents to pay income tax. There are either no or minimal state income taxes in the states of Wyoming, South Dakota, Alaska, Florida, Montana, Massachusetts, Nevada, and Indiana. And neither Wyoming nor South Dakota imposes a tax on either company profits or sales. Conversely, states like Louisiana, Nebraska, Maryland, Vermont, Minnesota, California, and New York have more stringent tax regulations.

What Is The State Tax Rate For Small Businesses?

The Tax Cuts and Job Act modified many state taxes, including those on individual income. Income tax is not implemented in every state. The Tax Foundation reports that some states provide bigger corporate tax breaks than others for smaller enterprises. Because of its low cost of living and lack of personal income tax, Florida is often cited as a top choice. Sales taxes are not collected in the state of New Hampshire, nor do income taxes in the state of Nevada. Many of the best states don't have any significant taxes.

On the contrary, some of the worst states are New York, California, and New Jersey. The high tax rates are a common denominator. For instance, New Jersey has the second-highest corporate income tax in the country, an inheritance tax, and a poorly structured individual income tax system, in addition to its high property taxes.

How Much Are Small Business Taxes?

According to the Small Business Administration, the average tax rate for small enterprises is about 19.8 percent. The average tax rate for small firms with a single proprietor is 13.3 percent, while the rate for those with two or more proprietors is 23.6 percent. The average tax rate for "small S corporations" (companies with less than 100 shareholders) is 26.9 percent. Since corporations often generate more revenue, they are subject to a higher tax rate. To put this in perspective, consider that about 60% of sole proprietorships earn less than $10,000 annually in net income, whereas over 18% of small S companies earn at least $100,000 annually.

How Much Profit Can A Small Business Earn Before Having To Pay Taxes?

The Internal Revenue Service requires all businesses to file an annual income tax return. Partnerships are required to file an information return. And if you have workers, you must pay employment taxes like social security. Self-employed individuals with annual incomes less than $400 are exempt from paying this tax. That, however, is the only tax you need not pay. One bright side is that the IRS won't care about auditing your company until it starts making money. Even if you're losing money, you should submit your taxes to take advantage of any deductions and prevent future legal trouble.

Conclusion

Fundera reports that the average tax rate paid by sole proprietorships is 13.3 percent, while the average tax rate paid by partnerships and corporations is 23.6 percent. The federal corporate income tax rate for C corporations was 21% when this article was written. The percentage is still the same as it was a year ago. Since yesterday, this price has remained the same. They will also have to pay their share of state corporation taxes, which may push the average top rate for all businesses in the country in 2021 up to around 25.6 percent. Have you started your own small business? If you include among your admirer's people like. To put it another way, 99.9 percent of all businesses in the U.S. are classified as small businesses.

Navigating the Terrain: The Advantages and Disadvantages of Tax Lien Investing

The Lure of Convenience Checks

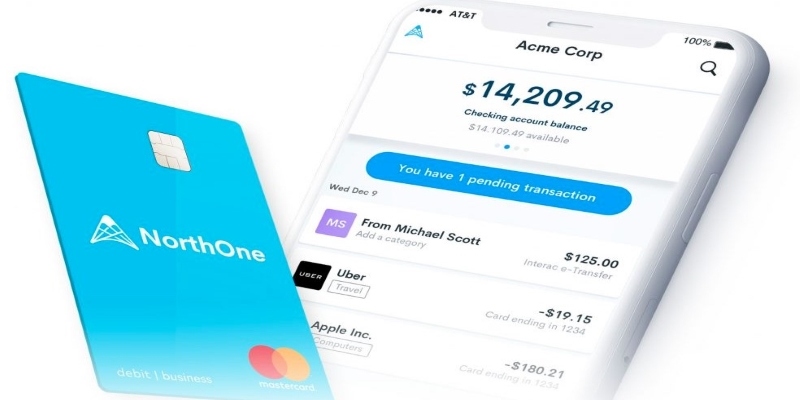

NorthOne Business Banking Review 2024: Simplified and Effective Solutions

Which Are The Best Long-Term Savings Plans That Make Good Financial Cents

Understanding the Role of a Private Banker: Is It Right for You?

Credit Cards That Offer 2% Or More In Cash Back On All Purchases

Capital One Venture X Rewards Credit Card: For Frequent Travelers

AI Powerhouses of 2024: 8 Companies Driving Innovation

What Is IRS Form 8949 And Its Purpose?